verify payments by check and notify account holders pre-emptively of check activity associated with their accounts. Chase bank gave it to him in the form of overdraft protection.Confirm the deposit each pay cycle by signing in to Chase OnlineSM or checking your account statement. After this happens, some people may be able to reopen accounts after a few years. Although Chase is a large company, it has just one web portal for its customers to check on their accounts. Federal Regulation CC governs how long you can be made to wait before drawing funds against your account based on the timing, the type (e. Thanks to the check 21 act, which allows check printing on any printer. Taking the check to the bank it is drawn on to present it for payment is the most direct way to verify funds.Chase ATM Withdrawal Limit If you have a basic Chase debit card, you can withdraw up to $3000 per day at your in-branch Chase ATM.

Merchants might fear that you’ve opened a brand new account (which signals greater risk for them) or that you’re using a poorly made counterfeit check. Calling is the most accurate way of checking your application status, but you can check it online if you already have a Chase account. number to verify checks drawn on jp morgan. It’s the Chase Bank check cashing policy in plain language.

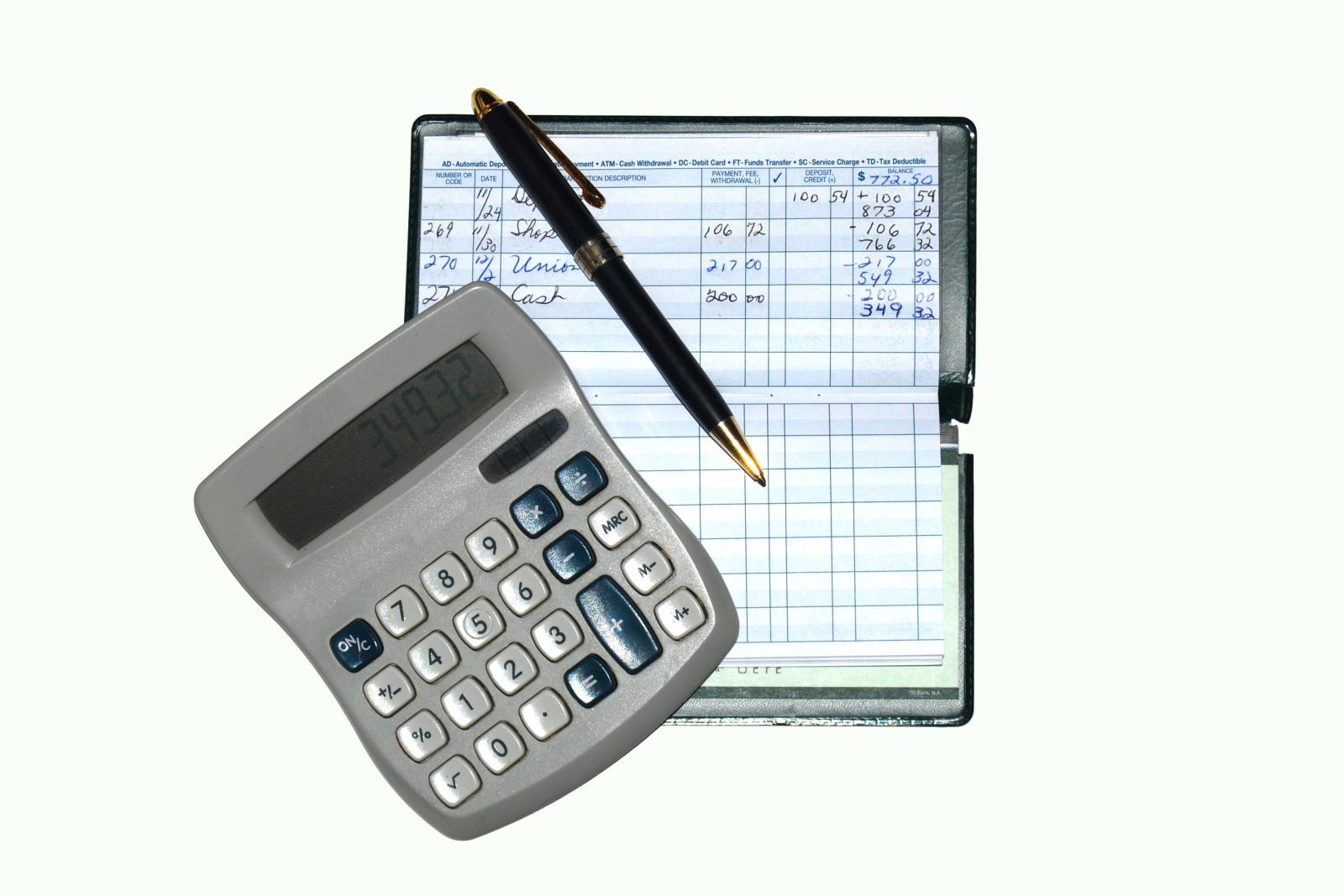

as a new Chase checking customer, when you open a new Chase Total Checking® account1 and set up direct deposit within 90 days of coupon enrollment. Chase checks can print at your home or office using Online Check Writer. These assets are together estimated to be over $2 trillion. Additionally, this check verification service provides balance validation for a handful of financial institutions. is a well-known multinational investment bank and financial services provider. com which is utilized by over 60,000 Mortgage Brokers, Banks and Merchants on a daily basis. See our Chase Total Checking ® offer for new customers. Yes, The company require background check.

You’ll be able to use the new card immediately once you verify it.

Our company specializes in providing a secure way to verify and safely pay via International Bank Account Numbers. Answer (1 of 5): There is a difference between a certified check and cashier’s check though essentially they both assure the recipient that the funds will be available when it is presented for cashing. I was already working there about two weeks when they came back with a misdemeanor charge that was thrown out and cleared. Verify a check from chase bank Please call us now at 61 to unlock.

0 kommentar(er)

0 kommentar(er)